People and businesses lose a lot of money due to check fraud every year. Check fraud, which includes check altering, account fraud, counterfeiting, identity assumption or theft, are crimes that exploit the weaknesses of the checking system. For example, several techniques for parting a client from his or her money include taking advantage of the float time, or significant wait time before a check is processed.

While check fraud is commonplace, individuals, businesses, and financial institutions can take steps to minimize the likeliness of these crimes affecting their business or accounts. Below are 5 tips to prevent various types of check fraud, whether you’re an individual, financial institution or business:

Check fraud working group

Criminals often take advantage of space on significant parts of a check to make alternations, such as adding an extra zero on the amount line. In order to prevent check altering, individuals should avoid leaving any significant blank spaces in the number or amount lines on checks according to the Check Fraud Working Group, a national coalition that publishes information about these crimes.

Another criminal technique is theft of a check or checkbook – for example, taking your checkbook out of your glove compartment during a car break-in and using the checks to make purchases. To stop check fraud by theft from happening, if a check is missing, you should presume it stolen and report the theft to your financial institution immediately – this will stop money from being taken out of your account.

Individuals aren’t the only ones who should be on guard. To catch alterations before they are processed, financial institutions should review checks to make sure that handwriting is consistent. Bank tellers should also make sure to always ask for identification in order to compare the signature and picture on the identification with the customer’s appearance and handwriting.

Preventing counterfeit checks from going through

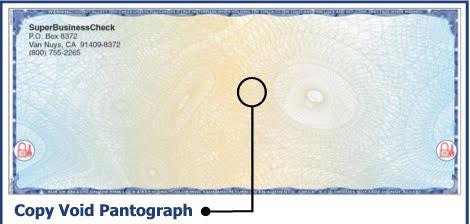

Another type of check fraud involves counterfeit checks. Technology like desktop publishing and photoshop has gotten so good that criminals find it easy to design and print out their very own illegal checks. Financial institutions and retail businesses should train their staff to inspect each check that passes across their desks, in order to make sure that the check they’re handling isn’t counterfeit. To do that, staff can be trained to look for lower quality paper and desktop publishing ink, which usually smudges when touched with a moistened finger, according to the Check Fraud Working Group.

How to prevent identity assumption

The most evasive of all check fraud crimes, identity theft or assumption is when a criminal assumes the identity of someone else and forges signatures on legal documents, such as checks, in order to receive someone else’s money or benefits. To keep this from happening, you should always be careful about keeping their financial information to yourself, and shredding check related documents before they go into the garbage.

Closed account fraud

This type of fraud, which involves the writing of checks that lead to closed and expired accounts, takes advantage of the float time, or wait time between the moment when a check is accepted, to the time when the check is processed. This type of fraud can be successful when customers don’t destroy checks from unused accounts or don’t inform their banks that they’ve closed their account. To protect against this kind of fraud, make sure you close down bank accounts actively instead of abandoning them, destroy checks from vacated accounts, and keep your bank in the loop about the status of your account.

Fraud from within

KPMG surveys, which keep track of fraudulent activities worldwide, have been seeing more and more reports of fraud coming from within companies and businesses. Unscrupulous employees can commit check fraud by issuing unauthorized checks, slipping in an extra zero or two onto a paycheck, altering pay slips and business reimbursement receipts, and more. In order to stop any employees from taking advantage of the system, businesses should put internal controls into place. These include using a system of checks and balances to make sure that no individual have complete control over a financial transaction. In addition, purchases, payroll and payouts should be authorized by a specific person in the company. If however your business is so small that financial work cannot be done by separate people, it’s best if your business receives an independent check of its financial goings-on by someone objective and independent, such as a board member.

Other prevention methods that can help prevent fraud include prohibiting the writing of checks payable to cash, which will minimize check theft, deface and keep voided checks, and require that checks can only be signed once all relevant information is filled out to prevent check alterations. Check fraud is a serious crime that is unfortunately commonplace. But with a few preventive measures in place, businesses, individuals and banks can better protect themselves against fraudulent activities.

Kpmg survey: https://www.omh.ny.gov/omhweb/resources/internal_control_top_ten.html

Check fraud working group: https://www.occ.gov/publications-and-resources/publications/banker-education/files/pub-check-fraud.pdf