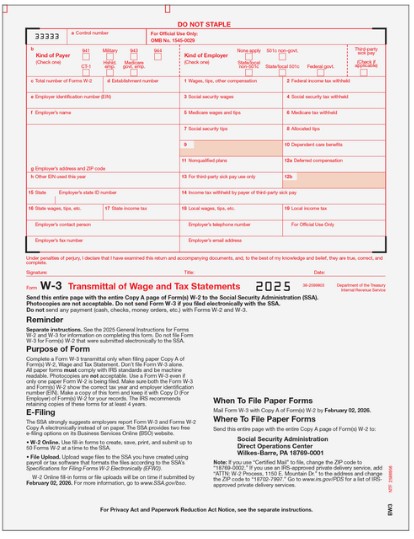

Form W-3 – Transmittal of Wage and Tax Statement

The W-3 form is used to summarize W-2 wage and tax information for submission to the Social Security Administration (SSA). You must complete one W-3 form for each employer filing W-2s.

This form is preprinted with red, scannable ink as required by the SSA and does not contain perforations. It must be mailed with W-2 Copy A in a batch to the SSA, and forms are ordered by the sheet.

Designed for laser printers, this form meets IRS and SSA regulations and is compatible with QuickBooks Desktop Payroll (Basic and Enhanced versions). Use this form with the corresponding W-2 forms you file.

This form is designed to support accurate, compliant year-end wage reporting and should be used with the corresponding W-2 forms when filing with the Social Security Administration.

Scheduled turnaround time is 1-2 days processing